Buying Property in Milan: Prices, Neighborhoods, and Mortgage Options

Buying Property in Milan: Prices, Neighborhoods, and Mortgage Options

Milan is Italy’s financial, business, and innovation capital — a city where real estate decisions are often driven by strategy rather than emotion. For foreign buyers, Milan represents opportunity: strong rental demand, international connectivity, and one of the most resilient property markets in the country. At LikeJunco, we support international clients every day who want to buy property in Milan but need clear guidance on prices, neighborhoods, and mortgage options available in 2026. This article breaks everything down in a simple, practical way.

Why Buy Property in Milan in 2026?

Unlike seasonal destinations, Milan is active year-round. Buyers choose Milan for:

- A stable and liquid real estate market

- Strong demand from professionals, students, and international workers

- Italy’s highest concentration of multinational companies

- Long-term value preservation rather than speculation

For many foreign buyers, Milan is about security, income potential, and future-proof investment.

Milan Property Prices in 2026

Milan remains the most expensive property market in Italy, but prices vary widely by area.

Indicative price ranges in 2026:

- Historic center & prime districts: €8,500 – €15,500 per sqm

- Central residential areas: €5,500 – €8,000 per sqm

- Semi-central and emerging neighborhoods: €3,800 – €5,200 per sqm

- Outer districts: from €2,600 per sqm

Despite global market shifts, Milan continues to show price stability and selective growth, especially in well-connected districts.

Best Neighborhoods to Buy Property in Milan

Choosing the right area in Milan is essential, both for lifestyle and financial performance.

Prime & Central Areas

- Brera – historic, artistic, high-end demand

- Duomo / Quadrilatero – prestige properties, limited supply

- Porta Venezia – elegant buildings, international appeal

Modern & Professional Districts

- Porta Nuova – business hub, excellent rental demand

- CityLife – modern developments, families and executives

- Isola – vibrant, popular with young professionals

Growth & Value Areas

- NoLo – strong regeneration, rising interest

- Bicocca – university district, solid rental yields

- Navigli (non-canal streets) – lifestyle appeal at more accessible prices

Each district attracts a different buyer profile, which directly impacts mortgage structure and bank assessment.

Can Foreigners Buy Property in Milan?

Yes. Italy allows full property ownership by foreigners, including non-EU buyers.

To purchase in Milan, you will need:

- An Italian tax code (Codice Fiscale)

- A notary (Notaio) to formalize the transaction

- Compliance with Italian anti-money-laundering rules

The legal process is straightforward, but financial preparation is key, especially in a competitive market like Milan.

Mortgage Options for Buying in Milan (2026)

Many international buyers believe Milan properties must be bought in cash. In reality, Italian banks continue to offer mortgages to foreign buyers, including non-residents.

At LikeJunco, we help clients in 2026 to:

- Access Italian banks that actively lend to foreigners

- Secure mortgages covering up to 60–70% of the purchase price

- Choose between fixed and variable interest rates, based on risk profile

- Finance primary residences, second homes, or rental properties

Milan is often seen positively by banks due to its strong rental market and resale liquidity, which can support mortgage approval.

Step-by-Step: Buying Property in Milan

- Clarify your goal – living, renting, or long-term investment

- Select the right neighborhood – price and demand vary significantly

- Obtain your Codice Fiscale

- Secure mortgage pre-approval with LikeJunco’s support

- Sign the preliminary contract (Compromesso)

- Complete the purchase with the notary (Rogito) and register the mortgage

In Milan, being financially prepared early often makes the difference between winning or losing a property.

Key Points to Consider Before Buying

When buying in Milan, keep in mind:

- Second-home taxes are higher than for primary residences

- Condominium fees can be significant in modern buildings

- Energy efficiency ratings increasingly affect value and financing

- Rental regulations vary depending on lease type

Careful planning helps avoid surprises and protects your investment.

How LikeJunco Supports Buyers in Milan

LikeJunco acts as an independent mortgage broker, working exclusively in the buyer’s interest. We help you:

- Identify the most suitable Italian banks for your profile

- Structure a mortgage aligned with your income and goals

- Handle documentation and bank communication efficiently

- Avoid delays and unnecessary rejections

Our role is to make the Italian mortgage process clear, transparent, and manageable.

Final Thoughts

Buying property in Milan in 2026 means entering Italy’s most dynamic real estate market. With the right neighborhood choice and a properly structured mortgage, Milan can offer stability, income potential, and long-term value.

👉 Book a free consultation with a LikeJunco advisor to explore mortgage options and move forward with confidence.

FAQs About Buying Property in Milan

1.Is Milan still the most expensive city in Italy in 2026?

Yes. Milan continues to have the highest average property prices nationwide.

2. Can non-residents get a mortgage in Milan?

Yes. LikeJunco works with Italian banks that offer mortgages to non-resident buyers.

3. Is Milan suitable for rental investment?

Very much so. Demand from professionals, students, and international workers remains strong.

4. Are houses or apartments more common in Milan?

Apartments are far more common than standalone houses.

5. How long does the buying process take?

Typically between 2 and 4 months, depending on mortgage approval timing.

Related Articles

Mortgage in Italy for Foreign Buyers: How Much Deposit Do You Need in 2026?

Buying Property in Milan: Prices, Neighborhoods, and Mortgage Options

How to Buy a House in Sardinia: Costs, Neighborhoods, and Key Tips for Foreign Buyers

Where to Buy a House in Umbria: Italy’s Green Heart for Expats and Investors

Buying Property in Calabria: The Affordable Gem of Southern Italy

Buying a Home on the Amalfi Coast: Dream Locations and What Foreign Buyers Need to Know

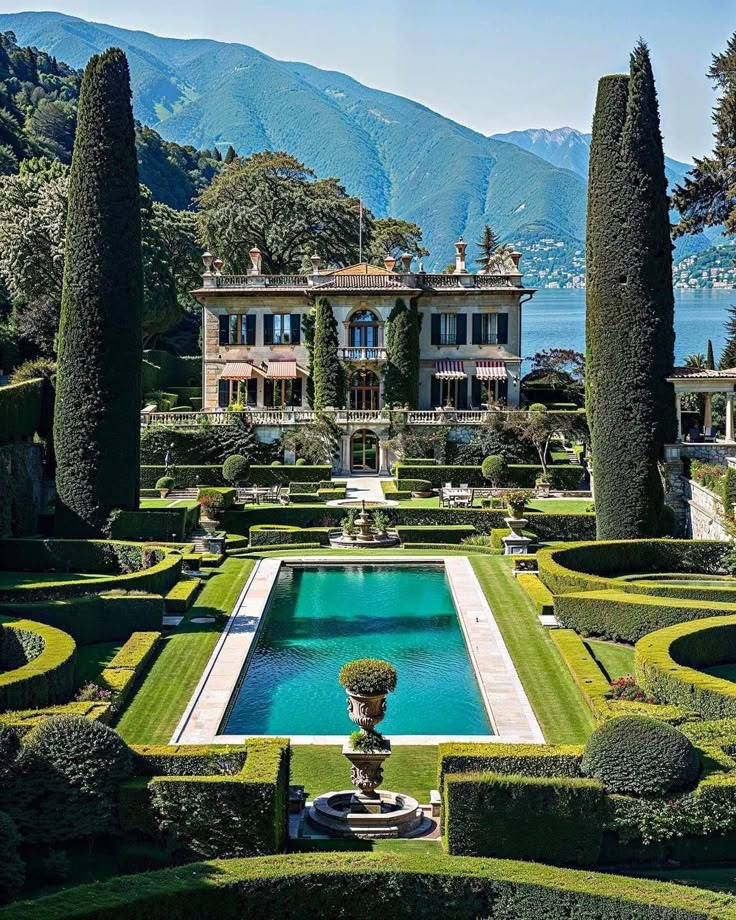

Buying Property in Lake Como: A Guide to Luxury Living in Northern Italy

How to Buy 1 Euro Houses in Italy: The Complete 2025 Guide

Where to Buy a House in Florence: Best Neighborhoods and How to Finance Your Tuscan Dream

Where to Buy a House in Rome: The Best Neighborhoods and How to Finance Your Dream Home

Moving to Italy from the US: How to Relocate and Buy a Home with a Mortgage

How to Buy a House in Sicily: Your Complete Guide to Affordable Living in Southern Italy

Buying Property in Italy: A Guide for British Buyers Post-Brexit

Where Buying Property in Italy Makes the Most Sense: Top Regions for Lifestyle, Value, and Investment

Buy a House in Puglia, Italy: Your Complete Guide to Owning a Home in the Heart of Southern Italy

Buying Property in Tuscany: What You Need to Know to Make the Dream a Reality

Buying Property in Italy: What You Need to Know Before You Invest (for Buyers from the US, UK, and France)

5 Things Americans Should Know Before Buying in Italy

Moving from the US to Italy: Why Make the Move and How to Buy Your Dream Italian Home with a Mortgage

A Step-by-Step Guide to Obtaining a Mortgage in Italy for Non-Residents

Challenges Faced by Foreigners When Buying Property in Italy

How to Finance a Vacation Home in Italy as a Non-Resident

Tax Implications for Non-Resident Property Owners in Italy

Best Regions in Italy for Property Investment as a Foreigner

Apply for an Italian Mortgage as a Non-Resident

Tax Benefits of Relocating to Italy

Why location is key when buying a home

Thriving in Italy Without Speaking Italian: A Guide to Living Your Dream

Renting vs. Buying: Pros and Cons Explained for the Italian Market

Real Estate market predictions for 2025

Embrace the Dream: Owning a Home in Italy is Within Your Reach

Fixed vs. Variable Rate Mortgages: Which to Choose?

First-Time Homebuyers: Key tips for success

Regions of Italy in a Nutshell

Renovation Loans: What you must know first

Get a Mortgage in Italy as a Foreigner: It Is Possible

This site does not provide advice or personal recommendations. While we are not advisers, all our partner advisers are fully regulated. By submitting your details, you consent to being contacted for an initial consultation. We will not use your information for other purposes or share it outside this service. Our partner advisers specialize in Italy expat home financing, ensuring expert guidance tailored to your needs.