How to Finance a Vacation Home in Italy as a Non-Resident

How to Finance a Vacation Home in Italy as a Non-Resident

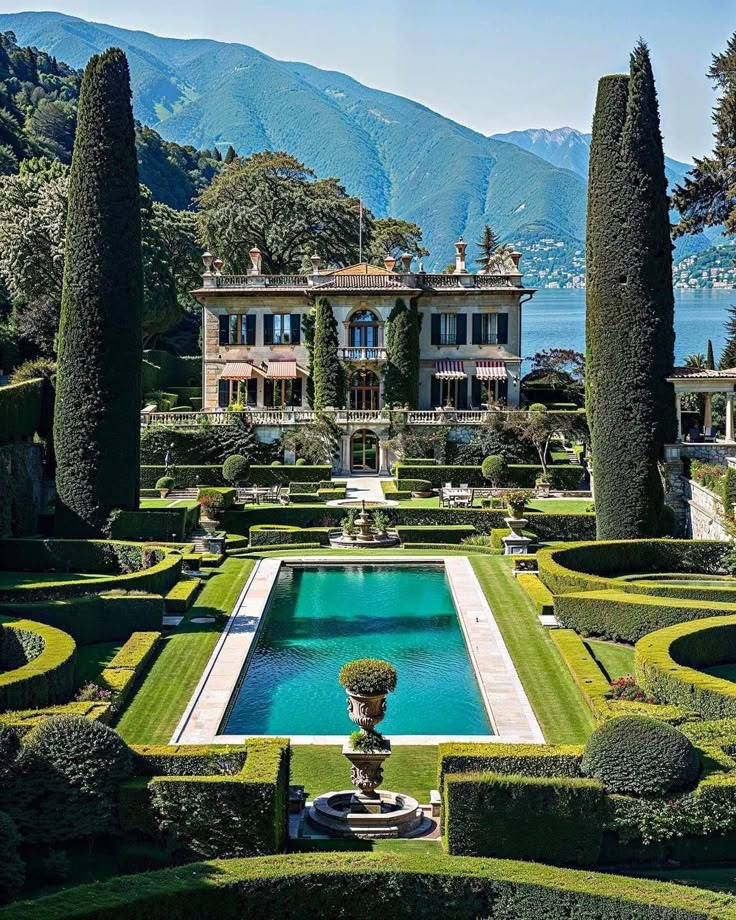

Dreaming of owning a vacation home in Italy? Whether it's a charming Tuscan villa, a seaside retreat on the Amalfi Coast, or a cozy apartment in Rome, purchasing property in Italy as a non-resident is absolutely possible. However, understanding the financing process is key to making your Italian dream come true. Here’s what you need to know about financing a vacation home in Italy as a foreign buyer.

1. Can Foreigners Get a Mortgage in Italy?

Yes! Italy welcomes foreign buyers, and non-residents can apply for a mortgage with Italian banks. While it’s common for international buyers to purchase properties in cash, financing options are available, often covering up to 60-70% of the property’s value. The loan terms typically range from 10 to 20 years.

2. Requirements for Getting a Mortgage in Italy

To secure a mortgage, you'll need to provide several documents, including:

- Valid passport

- Italian tax code (Codice Fiscale) – Easily obtainable through the Italian Revenue Agency

- Proof of income – Pay stubs, tax returns, and/or employment contracts

- Credit history – A solid credit score can help with loan approval

- Bank statements – Typically from the last 6-12 months

- Property details – Including an appraisal report from an Italian surveyor

It’s worth noting that banks will evaluate your financial profile to ensure you can manage the loan alongside any existing debts.

3. Finding the Right Lender

Not all Italian banks offer mortgages to non-residents, so working with a local mortgage broker can save time and help you find the best deal. Some of the top banks providing mortgages for foreigners include Unicredit, Intesa Sanpaolo, and BNL BNP Paribas.

4. Down Payment and Interest Rates

Italian banks typically require a 30-40% down payment, with interest rates varying depending on the lender and market conditions. In general, non-residents may face slightly higher rates than Italian residents, but rates remain competitive compared to other European countries.

5. The Buying Process: Step by Step

- Get Pre-Approval – Before house-hunting, it’s smart to get pre-approved to know your budget.

- Find Your Dream Home – Work with a local real estate agent to explore options.

- Make an Offer – Once you find the right property, submit an offer to the seller.

- Sign the Preliminary Agreement – This legally binding contract secures the deal and includes a deposit (typically 10-20% of the price).

- Secure Your Mortgage – Finalize your mortgage with the bank.

- Final Deed Signing (Rogito) – Sign the official contract in front of an Italian notary, pay the remaining balance, and get the keys to your new home!

6. Additional Costs to Consider

Besides the property price and mortgage, remember to budget for:

- Notary fees (minimum 5K and up to 3% of the property price)

- Mortgage registration tax (0.25-2% depending on residency status)

- Legal fees (1-2% of the property value)

- Property taxes (IMU and TASI, based on property type and location)

7. Alternatives to Italian Mortgages

If obtaining a mortgage in Italy proves challenging, consider these alternatives:

- Financing through a bank in your home country

- Home equity loan on an existing property

- Private lending options

- Buying with a partner or investor

Final Thoughts

Financing a vacation home in Italy as a non-resident requires planning, but with the right guidance, it’s a straightforward process. Partnering with an experienced mortgage broker can help you navigate the system, find the best rates, and make your dream of owning an Italian home a reality.

Looking for expert advice? Contact us today to explore your mortgage options and take the first step toward your Italian getaway!

Related Articles

Mortgage in Italy for Foreign Buyers: How Much Deposit Do You Need in 2026?

Buying Property in Milan: Prices, Neighborhoods, and Mortgage Options

How to Buy a House in Sardinia: Costs, Neighborhoods, and Key Tips for Foreign Buyers

Where to Buy a House in Umbria: Italy’s Green Heart for Expats and Investors

Buying Property in Calabria: The Affordable Gem of Southern Italy

Buying a Home on the Amalfi Coast: Dream Locations and What Foreign Buyers Need to Know

Buying Property in Lake Como: A Guide to Luxury Living in Northern Italy

How to Buy 1 Euro Houses in Italy: The Complete 2025 Guide

Where to Buy a House in Florence: Best Neighborhoods and How to Finance Your Tuscan Dream

Where to Buy a House in Rome: The Best Neighborhoods and How to Finance Your Dream Home

Moving to Italy from the US: How to Relocate and Buy a Home with a Mortgage

How to Buy a House in Sicily: Your Complete Guide to Affordable Living in Southern Italy

Buying Property in Italy: A Guide for British Buyers Post-Brexit

Where Buying Property in Italy Makes the Most Sense: Top Regions for Lifestyle, Value, and Investment

Buy a House in Puglia, Italy: Your Complete Guide to Owning a Home in the Heart of Southern Italy

Buying Property in Tuscany: What You Need to Know to Make the Dream a Reality

Buying Property in Italy: What You Need to Know Before You Invest (for Buyers from the US, UK, and France)

5 Things Americans Should Know Before Buying in Italy

Moving from the US to Italy: Why Make the Move and How to Buy Your Dream Italian Home with a Mortgage

A Step-by-Step Guide to Obtaining a Mortgage in Italy for Non-Residents

Challenges Faced by Foreigners When Buying Property in Italy

How to Finance a Vacation Home in Italy as a Non-Resident

Tax Implications for Non-Resident Property Owners in Italy

Best Regions in Italy for Property Investment as a Foreigner

Apply for an Italian Mortgage as a Non-Resident

Tax Benefits of Relocating to Italy

Why location is key when buying a home

Thriving in Italy Without Speaking Italian: A Guide to Living Your Dream

Renting vs. Buying: Pros and Cons Explained for the Italian Market

Real Estate market predictions for 2025

Embrace the Dream: Owning a Home in Italy is Within Your Reach

Fixed vs. Variable Rate Mortgages: Which to Choose?

First-Time Homebuyers: Key tips for success

Regions of Italy in a Nutshell

Renovation Loans: What you must know first

Get a Mortgage in Italy as a Foreigner: It Is Possible

This site does not provide advice or personal recommendations. While we are not advisers, all our partner advisers are fully regulated. By submitting your details, you consent to being contacted for an initial consultation. We will not use your information for other purposes or share it outside this service. Our partner advisers specialize in Italy expat home financing, ensuring expert guidance tailored to your needs.